This portfolio update comes with an abundance of optimism.

COVID lockdowns are lightening. Restaurants are open for serving guests and the warmer weather is here.

I’ve already had the opportunity to visit quite a few of my favourite establishments; it’s great to see so many familiar faces. Perhaps the best news is that movie theatres are also back open.

Both as a movie enthusiast and Disney (DIS) shareholder, I’m looking forward to catching Black Widow. They’ve done a great job overall with developing the Marvel Cinematic Universe on Disney+, so it’ll be nice to see how this new film fits in.

Table of Contents

Portfolio Update Summary

My portfolio earned dividend income from 17 Canadian and 8 American companies in June.

Please note that my JNJ dividends are received in CAD within my portfolio, so that is how I display them in the chart below.

CAD Dividend

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 20.88 | |

| Johnson & Johnson (JNJ) | 81.21 | 4.95 |

| Corby Spirit and Wine Ltd. (CSW.B) | 63.00 | |

| Fortis, Inc. (FTS) | 90.90 | |

| Canadian Utilities Limited (CU) | 103.35 | |

| Canadian National Railway Company (CNR) | 27.68 | |

| Hydro One Ltd (H) | 69.24 | 5.01 |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Metro Inc. (MRU) | 5.00 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 104.63 | |

| Brookfield Renewable Corporation (BEPC) | 25.70 | |

| Brookfield Asset Management (BAM.A) | 3.49 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 12.31 | |

| Brookfield Infrastructure Corporation (BIPC) | 1.23 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 5.40 | |

| Enbridge Inc. (ENB) | 20.88 | |

| Saputo Inc. (SAP) | 5.25 |

USD Dividends

| Company | USD Payments ($) | Div Change (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 24.44 | |

| McDonald’s Corporation (MCD) | 23.03 | |

| Yum! Brands, Inc. (YUM) | 16.58 | |

| Yum China Holdings, Inc. (YUMC) | 3.98 | |

| PepsiCo, Inc. (PEP) | 9.14 | 5.13 |

| Walmart Inc. (WMT) | 7.02 | |

| Visa Inc. (V) | 4.08 | |

| Microsoft Corporation (MSFT) | 6.19 |

Dividend Totals

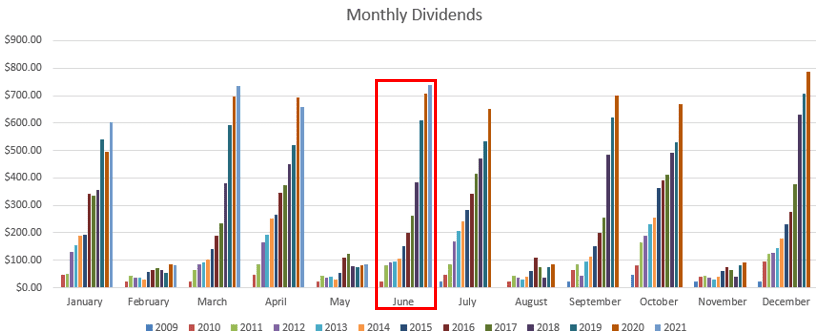

I earned C$645.25 and U$94.46, combining for $739.71 in currency-neutral dividend income. This is a record for June and represents a 4.38% increase from my June 2020 Portfolio Update.

Despite the hits of the last year, the dividend tower keeps getting taller:

My goal is to build dividend skyscrapers. And it’s really as simple as adding more money on a consistent basis.

Every dollar invested breeds more dividends.

Year To Date Progress

With the June totals included, the first-half of the year has brought me just under the psychological $3k threshold:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| February | 81.22 |

| March | 736.16 |

| April | 659.56 |

| May | 85.92 |

| June | 739.71 |

| Total | 2,905.52 |

The end of June also closes off the second quarter of the year. On that note, I published my Q2 2021 Dividend Report to Seeking Alpha. That’s worth checking out if you’d like to see my quarterly dividend income breakdown.

Market Activity and Cash

I decided this was a good period to consolidate my holdings and cash levels.

Through April and May, I was busy building out starter positions in cryptocurrency. This left me feeling stretched financially, so it was time to take a breather. I’ve never been entirely comfortable with being fully invested without something of a nest egg on the sidelines.

Market Timing and Opportunistic Investing

Research has repeatedly demonstrated that investors who try to time the market do poorly. Those who simply dollar-cost-average do better. The old adage is that time in the market is more important than timing the market.

Still, life happens. There is no better recent example of that than the COVID-19 pandemic. When the market tanked last year, I invested $10,000 in one month. I couldn’t have done that if I was fully invested.

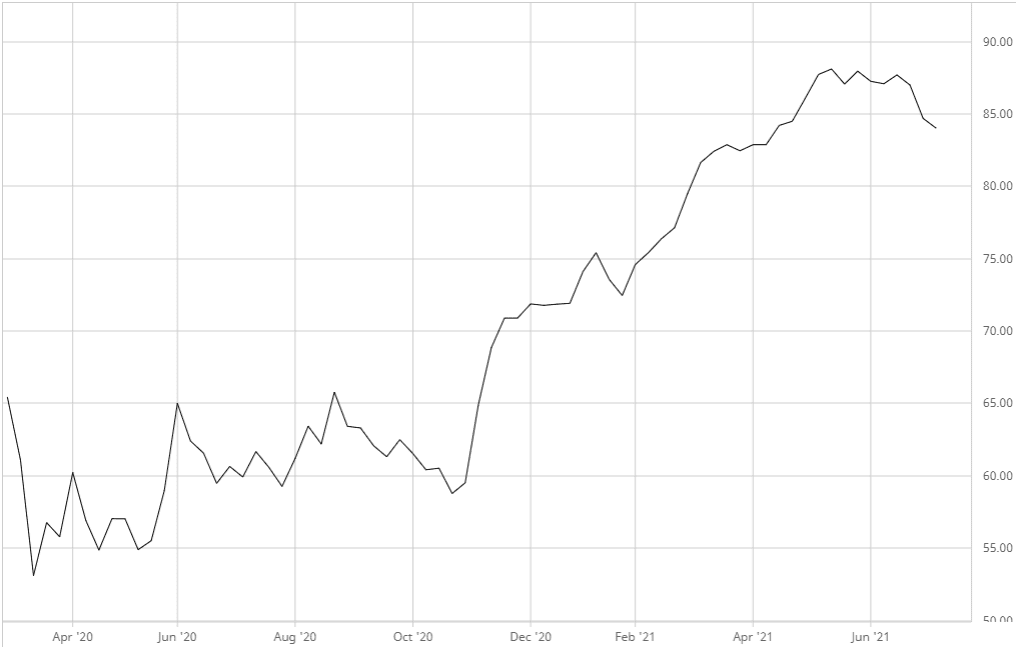

I was rewarded handsomely for my patience and conservative portfolio management. For example, I was able to snap up TD shares at a cost of under $50 in late March 2020:

Source: BarChart

I’ve brought in a return of around 70% since then as the shares trading at ~$85 presently. Beyond that, I’ve received quarterly dividend payments.

It all was possible because I was ready to act when the time came. The booms and the busts in the market matter.

Dividend Income Expectations

Given that my most recent investments in tech names and cryptocurrencies pay low-to-no passive income, I am not expecting any considerable jump in passive income in the near term. Nevertheless, branching out without my investment dollars is a move I feel good about.

After over a decade of focused investment in dividend growth companies, adding a broader base to my portfolio is sensible. Further, it’s now something that I feel I can afford to do. Taking calculated risks makes the most sense from a position of strength.

Related Post: Are Dividends the Only Option?

Conclusion

As we enter the second stage of 2021, there is plenty to look forward to. The possibility of concerts, sports, and other regular-life-events stands right on the horizon.

The reopening of the economy also bodes well for my portfolio. Consumers spending money is what keeps the economic wheels churning. My coffers get filled with dividend income as a wonderful by-product of those wheels churning. That’s a win-win for everyone.

Monthly dividend totals above $700 are becoming the norm, and that’s something I can get used to. The dividend income is all the more secure since it comes from over 25 high quality companies.

Thank you for reading.

Ryan Full Disclosure: Long DIS, REI-UN, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, MRU, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, PEP, WMT, V, MSFT, TD

Great stuff Ryan

Gotta love the companies paying you and bringing in over 700 yet again this month.

keep at it, nice buy with td!

cheers.

Passivecanadianincome recently posted…June 2021 Passive Income – Good Times!

Hey Rob,

Yeah, still feels surreal cashing in with amounts this high on a monthly basis. The strategy pays real dollars and cents!

Take care,

Ryan