The third month of the year brought with it some warmer weather, melted snow, and a loosening of COVID restrictions. I have to say it has felt great to see restaurants with tables filling up again.

Businesses earning money and regular folks making a living is a wonderful thing.

On the investing front, some steady progress was also made.

Table of Contents

Dividend Summary

I earned passive income from seventeen Canadian companies and seven from the US. The cash flow is well-distributed across 24 diversified, top notch businesses.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 22.19 | 6.25 |

| Johnson & Johnson (JNJ) | 86.14 | |

| Corby Spirit and Wine Ltd. (CSW.B) | 12.00 | |

| Fortis, Inc. (FTS) | 96.30 | |

| Canadian Utilities Limited (CU) | 104.39 | 1.00 |

| Canadian National Railway Company (CNR) | 32.96 | 19.11 |

| Hydro One Ltd (H) | 69.24 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Metro Inc. (MRU) | 5.50 | 10.00 |

| Brookfield Renewable Partners L.P. (BEP.UN) | 115.81 | 5.35 |

| Brookfield Renewable Corporation (BEPC) | 52.82 | 5.35 |

| Brookfield Asset Management (BAM.A) | 3.90 | 7.68 |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 13.71 | 5.88 |

| Brookfield Infrastructure Corporation (BIPC) | 1.37 | 5.88 |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.20 | |

| Enbridge Inc. (ENB) | 21.50 | 2.99 |

| Saputo Inc. (SAP) | 5.40 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 27.63 | 13.04 |

| McDonald’s Corporation (MCD) | 24.64 | |

| Yum! Brands, Inc. (YUM) | 18.90 | 14.00 |

| Yum China Holdings, Inc. (YUMC) | 3.98 | |

| PepsiCo, Inc. (PEP) | 9.14 | |

| Visa Inc. (V) | 4.79 | |

| Microsoft Corporation (MSFT) | 6.86 |

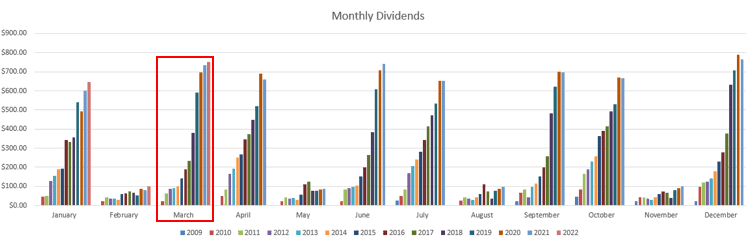

My portfolio raked in C$654.53 and U$95.91, combining for a currency-neutral $750.44. This represents a slight 1.94% increase over my March 2021 dividend totals.

Standouts

Canadian Utilities – CU posted a 1.00% dividend increase. This represents 50 consecutive years of increases and represents the longest track record for a Canadian company. Certainly, this is only a tiny raise, but it’s the growth trajectory that counts. Crossing that 50-mark puts CU in the Dividend King category, which is a real feather in the cap.

I’ve been on board with CU since late 2015 when I picked up my first shares. Since then, I’ve seen my starting yield steadily climb with seven dividend increases.

Although the energy situation in Alberta has posed a headwind for the business, I intend at this point to hold. My yield on cost is healthy and the dividends can simply be redeployed elsewhere.

RioCan – REI-UN put up a 6.25% increase to its distribution. This is the first bump since the devastating 33.33% cut from February 2021. While it doesn’t bring things back to where they were, it’s a start.

Since the decrease last year, I’ve basically put this one in my portfolio penalty box. As with CU above, I do have a healthy yield on cost with RioCan, so I intend at this stage to just redeploy the cash flow.

There is a reasonable possibility that they’ll deliver on their plans to develop multipurpose real estate, but I have very little trust overall in management’s ability to raise the distribution meaningfully at this stage. It’s difficult to get back confidence in a company after a management change and subsequent income slash.

They have a lot to prove at this point.

Year To Date Progress

March pulled in a nice record total. Crossing the $750 barrier is a solid psychological threshold:

On a combined basis, I’m up to a healthy $1,497.84 across the first three months of the year:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| March | 750.44 |

| Total | 1,497.84 |

Market Activity and Cash

I’ve continued to accumulate cash on the sidelines. I can’t say that I find anything particularly interesting in the markets at this point.

At the time of writing, stocks have begun to pull back, but we’re already talking about a frothy market. All the same, the amount of geopolitical tension that presently exists is likely to produce some market volatility.

There’s nothing out of the ordinary here. Being ready to strike when the time comes is good enough for me. I’m likely to nibble here and there even without a great market drop, but am most hoping for a significant dip.

Conclusion

My cash flow totals through March were encouraging. Getting three quarters of the way to a thousand dollars for a single month’s dividend income is great. That’s all money that will be reinvested selectively into high quality companies.

Following this formula for compounding has been the hallmark of my investing success. There’s no reason to shake things up with a proven strategy.

– Ryan Full Disclosure: REI-UN, KO, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT